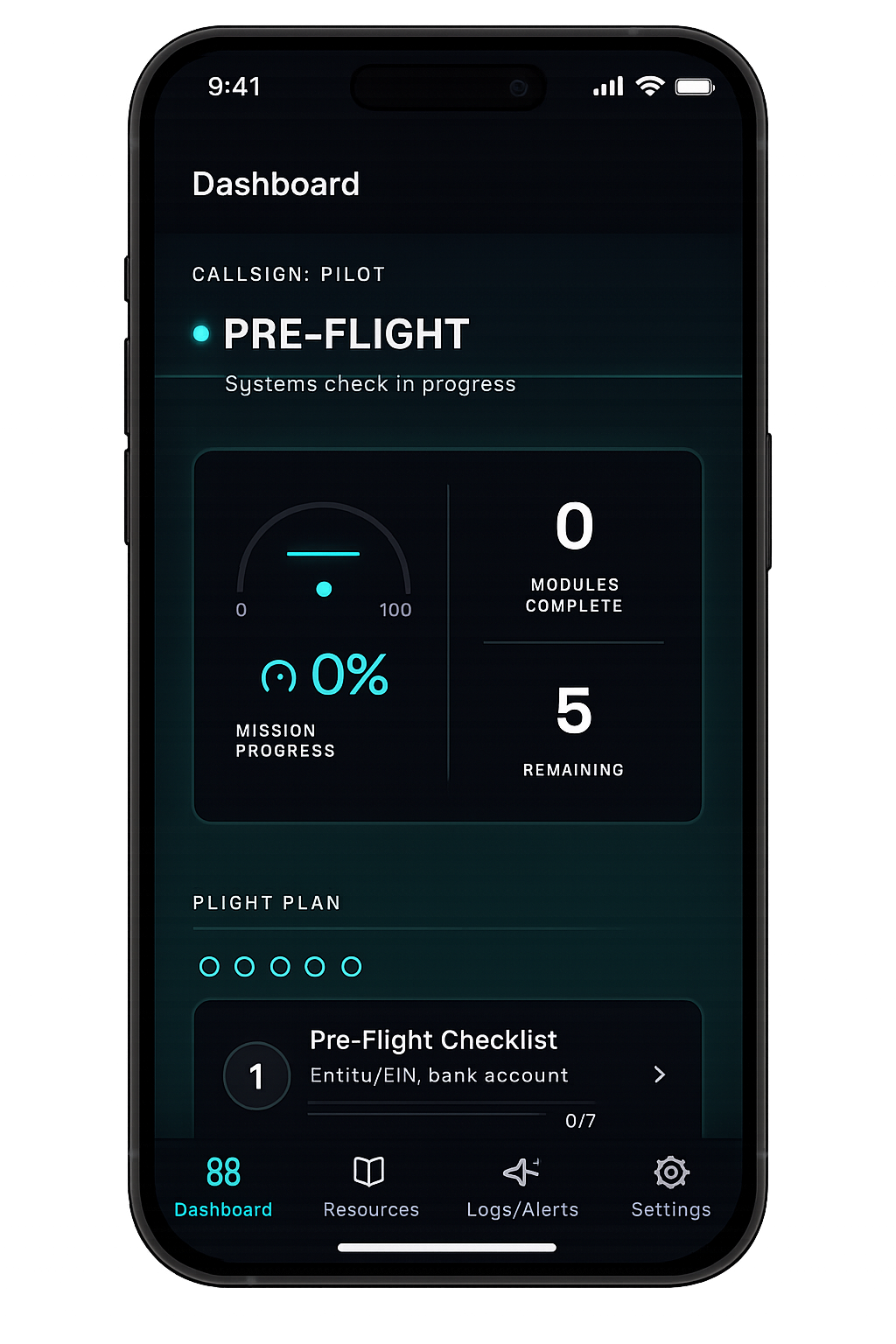

System status overview

Track progress in real-time

Step-by-step guidance

Build credit independently

Built for entrepreneurs at every stage—whether you're just starting or ready to scale

It needs infrastructure, credibility, and smart systems that scale

Build business credit the right way with step-by-step guidance. We help you establish the foundation lenders look for - proper structure, EIN setup, D-U-N-S registration, and business listings that build credibility from day one.

Follow a proven path from Tier 1 starter vendors to Tier 4 premium credit lines. Our sequenced approach helps you build payment history, establish trust with bureaus, and unlock funding opportunities.

Know exactly what lenders need to see before you apply. We help you understand credit scores, payment history requirements, and documentation that gets you approved faster with better terms.

AI-powered automation that scales your operations without adding workload. Custom apps, intelligent chatbots, booking systems, and workflows designed specifically for your business needs.

From foundation to funding in three clear stages

Start with the right structure. We guide you through business entity formation, EIN setup, D-U-N-S registration, and business listings. Get your foundation right before building credit.

What you'll complete:

Begin building business credit with clarity. Work through Tier 1-4 vendors, establish payment history, and strengthen your credit profile with strategic sequencing.

What you'll complete:

Strengthen your profile and prepare for growth opportunities. Access funding, implement smart technology, and scale operations with AI-powered systems.

What you'll access:

Whether you're just starting or ready to scale

Everything you need to know about building business credit

Most businesses can establish a foundational credit profile within 3-6 months by following our structured approach. Building to funding-ready status typically takes 6-12 months, depending on your starting point and consistency.

No. Business credit is separate from personal credit. While some early vendors may check personal credit, our program focuses on building business credit independently so you can access funding without personal guarantees.

Complete step-by-step guidance, vendor database, document organization, progress tracking, automated reminders, funding checklists, and ongoing updates. Everything you need in one platform.

No. We provide the tools, guidance, and structure to build a strong credit profile, but we cannot guarantee lender approvals. Each lender has their own criteria and approval processes.

Yes. We offer financing options for qualifying clients on consulting packages and smart technology builds. Speak with our team to learn about current financing terms and eligibility.

We combine business credit education with smart technology solutions. You're not just building credit - you're building systems that scale. Plus, our app keeps everything organized in one place.

Everything you need to build business credit and scale with technology

Complete credit building platform with guidance, tools, and tracking

Step-by-step foundation setup

Credit building roadmap

Vendor database access

Progress tracking dashboard

Document organization

Automated reminders

Ongoing updates

App access plus one-on-one expert guidance and strategy sessions

Everything in Business Credit App

Monthly strategy sessions

Personalized roadmap

Funding readiness review

Priority support

Custom recommendations

Direct expert access

Custom technology solutions for automation and operational scaling

Custom mobile apps

AI chat & automation

Booking systems

Customer portals

Workflow automation

Integration support

Ongoing maintenance

Financing options available for qualifying clients

Join hundreds of entrepreneurs building credibility, accessing funding, and scaling with smart technology